I don’t claim to be a financial guru but I wanted to share some things that have helped me on my journey to early retirement and financial freedom. I still have a ways to go before I achieve some of my goals but have made great progress along the way. When you think of financial freedom, what comes to mind? For me, it’s not having to live check to check and worry about unexpected expenses.

It’s about making sure my family is well taken care of and having the freedom to pursue hobbies, passions, and interests without being tied to a 9 to 5. Ultimately it’s about having the time (freedom) to live a more fulfilling and abundant life.

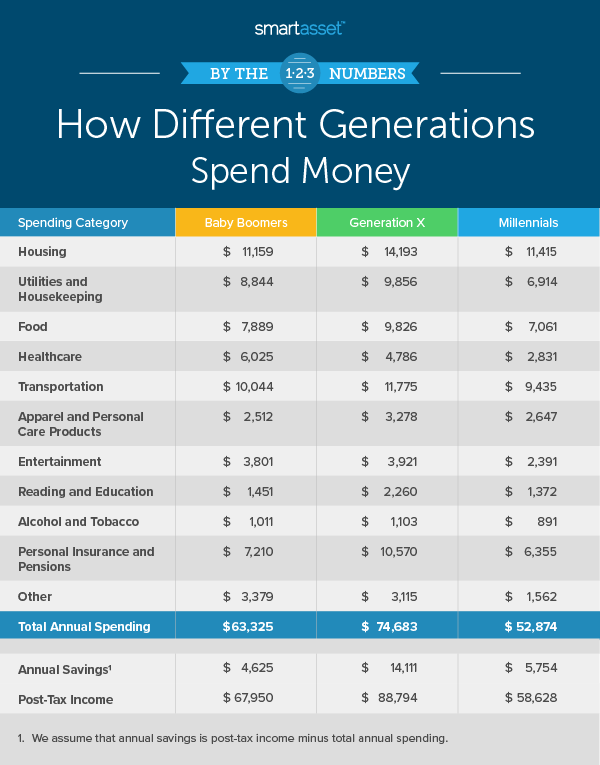

It’s up to us to determine what that means or what an abundant life looks like. I found a few charts below that provide a good snapshot or idea of how we fare when it comes to our finances based on age group. We’ll take a closer look at those in a moment.

But for me, as a believer, I believe that we can experience an abundant life that Jesus speaks of in John 10:10 which is rooted more in the spiritual element of freedom rather than the materialistic element; however, we can have nice things and enjoy the niceties or finer things of life on this side of heaven too.

But I’ve found that true joy, peace, and happiness comes from the simple things in life and not so much in the stuff I own: spending time with family/loved ones, embarking on a new journey that fits your passion, sunshine, health, strength, learning more about what makes you happy are all things we can enjoy with little to no costs (depending on how we go about it).

I wasn’t taught in depth about finances growing up, but my parents did a great job showing me that hard work pays off. And though we had our financial challenges and hardships growing up, we had food on the table, clothes on our backs, and a roof over our heads which was enough to get us by. I started working when I was 13 for one of my friend’s parents renovating homes and cutting grass. I bought the latest kicks, clothes, gaming systems, and felt like I was on top of the world!

Waking up at 4:30am every weekend was worth it when I saw the rewards, a good paycheck and the feeling of achievement! And free food sometimes when we went to work, which was also a plus. It definitely beat getting made fun of for having hand me down clothes and off brand shoes. But that’s to be expected when going to public school. It all builds character though and we worked hard, played hard, and spent our money fast when we got it.

This was a habit I had to work on or correct well throughout adulthood. I eventually landed a telemarketing job when I was 16 where I saved up for my first car (an 89 Ford Mustang, 4 cylinder with a lot of issues). It was my car and I was proud of saving my paychecks to purchase it. It cost roughly 1100 dollars (repairs a bit more, which I paid for as well). But it taught me the importance of saving money.

From there, I went into the military when I was 19 and saved up a good amount of money after being deployed to Kuwait and Iraq for 10 months during Operation Enduring Iraqi Freedom in 2003. Though I still deal with issues till this day from serving in the military, it taught me many lessons.

Some about enduring hardships, the importance of creating bonds, and being selfless. Others about the importance of money management and that life is too short to take for granted.

I’ve also learned a lot from working in the corporate world when it comes to perseverance, finances, and money management, but I’ll save that for another blog post. We all have our own stories and experiences with money or finances and know that it’s not easy to manage at times. We also have stories about the victories we have with money as well. Take a moment to think about your journey so far…

Think about the successes you had with money. How’d it make you feel? What was your mindset at that time? What steps did you take to accomplish your financial goals? Who helped you along the way?

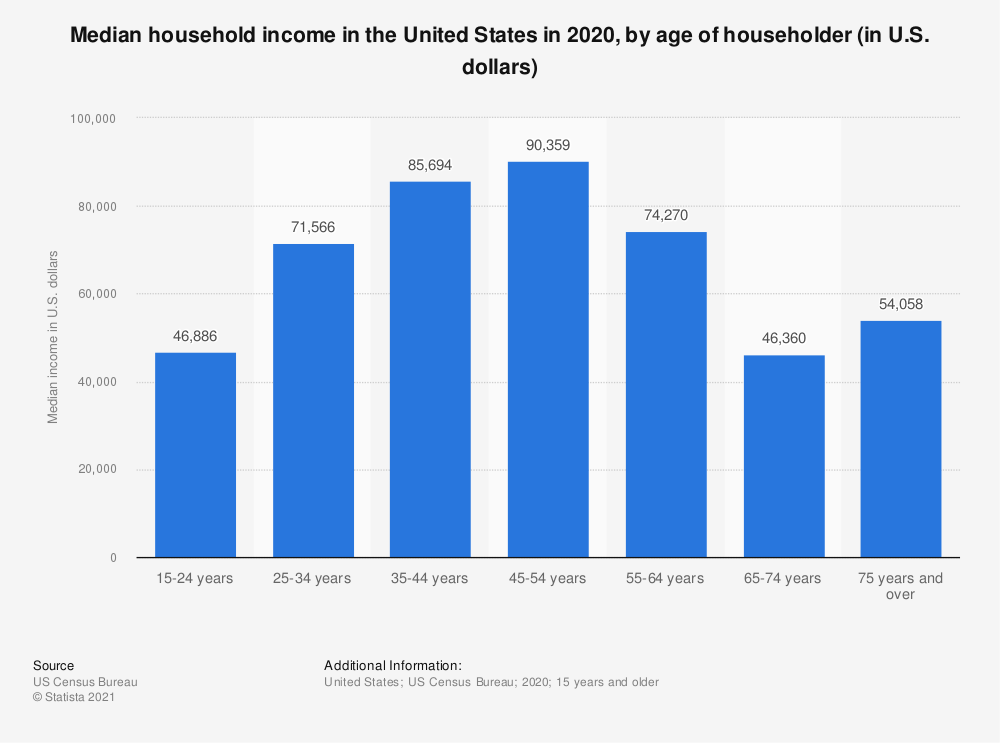

These are things to remember to continuously help us on our journey to financial freedom and stability. Below is a look at the median household income by age in 2020 (which is gives us a projection of where it is currently).

Regardless of our age, the pandemic or challenges with the economy, If we made progress in our financial journey before, we can get refocused and do it again! We may have to get more creative when it comes to earning income. However, looking at the chart, with Gen Z being the lowest earners at $46,886, that shows we’ve made great progress in spite of our challenges. I’m thankful for the opportunities that came my way and the people who helped me on my journey.

When I didn’t have a place to stay or was in between jobs, they gave me wisdom and encouragement to keep pressing. Some gave me opportunities to make a decent living as well. And though they may or may not be in your life now, let the kindness that they showed be a reminder of the importance of being in position to help someone else out when you can. That brings me to my 5 points or tips we can use to help us find what works financially for our situation:

GIVE/BUDGET

Give your complete focus and attention to your journey to financial freedom! Also, this may seem a little backwards or counterproductive especially when we’re trying to save money, but I’ve found that when I’m generous, I have more than enough to take care of my family and can continue to work towards our financial goals.

This tip is for personal finance and businesses as well. If you believe in giving tithes and offering to your local church or giving to charities, that is a good place to start; however, giving doesn’t always have to be monetary.

Giving time, energy, and a helping hand to those in need, can also be rewarding and set us up for blessings and good fortune as well. In my experience, hard work and generosity always pays off. Whether financially or mentally/physically it can put us in a good space and be uplifting.

It can also condition us to have an attitude of gratitude which can relieve stress. Having a budget can also be impactful in how we establish and complete our financial goals. Personal accountability and accountability from our spouse or partner, can help us stay on track with our spending habits and budget as well.

My wife and I tried different budgeting methods: Dave Ramsey’s every dollar app, putting money in envelopes for food, gas, and other expenses, keeping money in a stash box for a rainy day, using a Microsoft excel spreadsheet and bank statements to track all spending, all of which were effective.

However, we’ve found what worked best for us was writing out a budget, reviewing it before spending money, and sticking to it. We wrote down our monthly income and subtracted our expenses from there. Not to where we zero it out but we had a guideline of what we wanted to spend and have left over every month.

This is not as tedious as having every cent accounted for every month which can be overwhelming. We use our notepad or memos on our phones to track it and update it accordingly as some expenses or bills fluctuate each month. The money we have left over, we either keep it in our checking account or put it in savings.

We invest some as well. We sometimes switch between budgeting methods and use money for gas and food to switch it up. This can break up the mundane aspect of budgeting and make it enjoyable as possible.

Also giving ourselves an award for sticking to budget week to week, allowed us to enjoy fast food on the weekend (within budget). Documenting and celebrating our progress was CRUCIAL to how disciplined we remained through our journey.

We definitely had our moments…(spending outside of budget and complaining about eating the same thing over and over again. Only so many ways you can eat chicken, rice, and sloppy joes 🙂 Ok we had other stuff too but it’s easy to focus on the parts we didn’t like as much (laugh out loud).

SAVE

Following Dave Ramsey’s baby steps (the first three in particular) is a good place to start building your savings account. The link for the full 7 steps can be found here. The first three steps are:

1. Save $1000 in an emergency fund or savings account at your local bank.

2. Pay off debt using debt snowball, smallest to largest not including mortgage.

3. Save 3-6 months of monthly expenses in an established emergency fund. You can keep it in a safe as well but just make sure it’s in a secure location. This is for unexpected costs when life happens. Saving 5 to 10% of your income each month or each pay period is a good place to start. We were able to save almost a year worth of my salary in 18 months. To accomplish this, we put any additional income or money that came in (stimulus, income tax returns, bonuses, pay increases, and money already allocated to savings each month) into our savings account.

We made close to six figures during this time as well. This is the most money we’ve ever made as a couple. We are thankful for this as it was something that we prayed for and wrote down as a goal and vision for our family. You may have to pick up an extra gig(s) or hours in order to maximize your income and savings as well once you establish that you want to build your savings and pay off debt. We had multiple sources of income during this time as well.

PAY OFF DEBT

Income and budgeting plays a big part and how quickly we pay off debt. Limiting frivolous spending helps as well. We always want to count the wins or progress made so tackling the smallest debt first works best (the snowball effect). Our income exceeds our expenses now as we were able to pay off the majority of our debt.

Curving our spending habits helped us establish a budget we could stick with. Though challenging, since we were making more money during this time, we were intentional with how our money was spent.

We determined what we needed to do to stay within our budget and documented our progress of paying off debt (credit cards, personal loans, vehicle payments included). Seeing our progress was more motivation to keep going.

Once you get to this point, it’s easier to look into pursuing other passions (writing, podcasting, making YouTube videos, and higher learning for example). You can always work on your craft or further your education while working a 9 to 5, it’s just more challenging to do so. But you can do it! Just stay the course.

INVEST

Learning and following through with investing in 401k (8-20% of gross income is a good starting point depending on budget and what’s feasible), mutual funds, money market accounts, Roth IRA (Individual Retirement Account), and individual stocks can help grow our nest egg substantially for retirement.

Creating a practical plan is key when allocating funds to these investments. Researching and talking to financial advisors can help as well. Google and YouTube has good info on how to get started investing as well.

With brokerage or investment apps like Robinhood, WeBull, Uphold or TD Ameritrade for more advanced investors, getting into investing has become more accessible. Crypto currency and NFTs (non-fungible tokens) are more investments we can look into and do research on. More on how to setup NFTs under the resources tab here.

Dividend stocks are a good place to start when it comes to investing. It does come with risks (losing money on investments) so making sure research is done and money is allocated towards investing before starting, is a good approach to take. Real estate is another investment to look into as well, starting with the house or rental properties you’re looking to purchase.

ENJOY LIFE BUT STAY DISCIPLINED

Enjoy life! Set aside time and money for stuff you and your family enjoys. Vacations, entertainment, cool toys (for your kids and yourself lol) are all a part of what makes this journey worth it! We still want to stick to our budget, though some may choose the minimalist lifestyle as they find it more fulfilling; which is great too!

Staying disciplined will help us stay the course and perpetuate our success if we ever stray off the path. Which does happen. I’ve definitely bought my share of toys or wants (cars, video games, sports equipment) and had to get back on track. I’m thankful I’ve had the opportunity to make good money in my life and believe there’s more to achieve ahead.

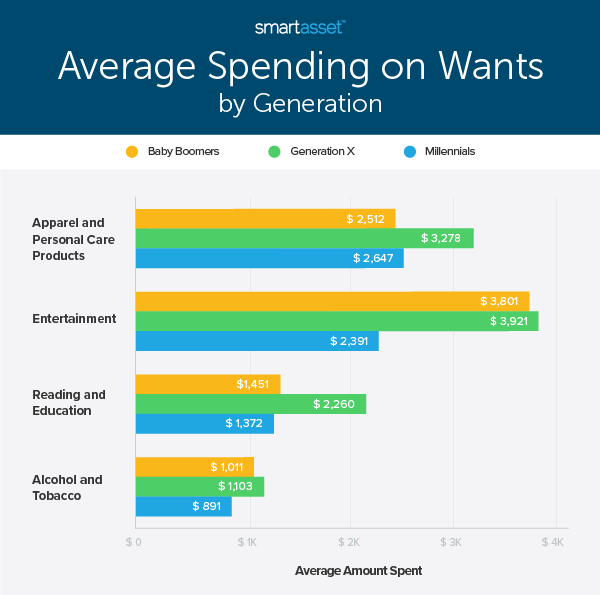

Teaching my children about finances and setting them up for success is at the top of that list. Also looking at needs VS wants can help us confirm if it is in the budget or not. Why is this a need? Does it meet our definition of what that is?

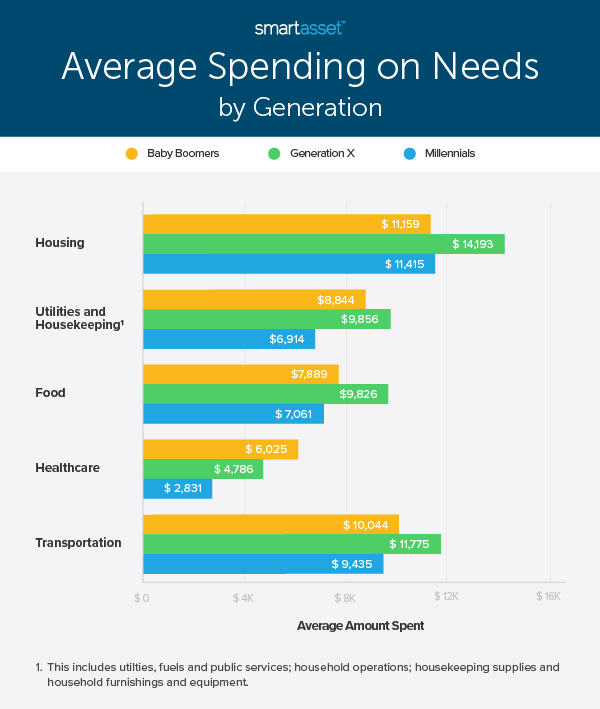

Does it help sustain our current living situation? If it helps improve it, it may be a need as well, we just have to weigh the pros and cons or cost of it. Below are charts that give insight on how we view needs and wants as well as how we spend money based on generations.

I found these charts interesting and encouraging as it shows we have similar mindsets regardless of our age. It also shows that we are passing down information/knowledge that will help transform and educate the next generation. But getting back to needs VS wants, we had our heat go out in the dead of winter one time. We needed to improve our living situation so we got the necessary repairs to fix it.

We had money saved for that very reason. After that, we thought about getting additional space heaters, but decided to wait on that as it was no longer a need since the heat worked and we already owned several. So asking yourself “do we really need this” is a good approach to staying within your budget.

Also taking a calculator or using your phone when you shop can help us stay within budget as well. We all know how easy it is to go over budget at Wally World or stores like Ollies ( I still don’t know how we overspend at Ollies sometimes, even with a calculator).

These 5 tips are a guideline that can help you formulate a financial plan that works best for you. The beauty of finding what works for us financially is we can always pick up where we left off! I’ve been laid off before and had to modify the Game Plan, which is ok because life happens.

Though that time in my life was challenging, it made me appreciate the time where I had money to work the plan and towards our financial goals more effectively. It also reminded me that the plan is still the plan regardless of where we are financially.

We may have to tweak it some due to circumstances, but like a road map, we can come back to it for guidance even if there is new construction or roadblocks in the way. And the plan we implement may not work for everyone, and that’s ok too. You may have to try different approaches to find what works.

Once you find what works best for you, stick with it! Being consistent is one of the keys to unlocking financial stability and freedom in our lives. I hope I’ve given you some ideas on where to start when it comes to money management or working your financial plan.

If you would like info or insight on individual stocks I own through Robinhood that yield dividends, please reach out to me through our Get In Touch us page on the Not Your Average Boss website. Happy holidays to you and your family! I wish you a happy, blessed, and productive New Year as well! Happy planning!

2 replies on “Finances: 5 Tips To Find What Works Best For You and Stick With It!”

Very helpful information being young I’ve trying to learn budgeting and this will help me think about certain things like how to avoid spending on unnecessary items, how to put money to the side, and setting goals

LikeLiked by 1 person

That’s Awesome! Appreciate your comment and you checking out the blog! You got this!

LikeLike