We all have experiences with money; whether good, bad, or indifferent. When it comes to personal finances, it can be challenging to share our experiences, encouragement, and advice with friends family and our circle of influence, especially if we’re not gurus. We work hard for our money, so allowing people to give us advice on how to better manage it can cause us to become defensive and not receptive if we’re not ready to change or to have that conversation.

However, when it comes to any advice, it’s up to choose and use what best applies to our current situation. It’s also good to research different money management methods like budgeting, saving, debt amortization, and investing when it comes to building wealth. It challenges us to create better habits with our finances especially if we’re getting the same results (overspending, more debt, not knowing where money is going every month, living check to check) every year.

In this post, we’ll be reviewing former Dave Ramsey personality Anthony Oneal’s recent podcast episode “10 Things You NEED To Do Before 2024” and highlighting several key points. This episode is mainly regarding finances and how we can better prepare for success in 2024 and beyond. A link to the full episode will be provided at the end of this blog post.

Anthony or AO has been doing BIG things in the podcast and personal finance space since he started with Dave Ramsey and created his own channel The Table. This particular episode resonated with me as it was humbling, informative, and self-reflective. Before we look at his downloadable show notes, I want us to think about these questions as the answer can determine how we view the points in this episode and how we apply them to our lives going forward:

- What is Your Definition of the American Dream?

2. Can The American Dream Still Be Obtained or Is It Just A Fantasy?

3. If you earned more than 100k a year would that change your current financial situation? If so, how can you maximize your profits or earning potential to get close to this financial goal?

The honest answer to these questions can help us put things into perspective and help us determine a plan of action that works best for us and our family.

Let’s Take A Look At Anthony’s Show Notes For This Episode:

I want us to take a closer look at points 1, 2, 4, 8 and 10 as we formulate our financial plan for the new year.

- Reflect on Financial Wins and Missteps

- When we count the wins in life, no matter how small, we create a mindset of gratitude which can give us momentum or motivation to keep going down that path of progression. This is the same for monetary wins. When we move the needle toward the direction of positive gains, it’s encouraging and reinforces that our plan is effective. This in turn can boost our morale and keep us on track with our financial goals.

- Confronting missteps or bad/not necessary financial decisions can help us become more accountable to ourselves, our partners, and family when it comes to our vision. This is where we can see where our money goes and how we can reassess our behavior or belief system concerning our spending habits. If we need to adjust and work on creating positive spending habits that give us more money each month, this is where we start.

- Review Last 3 Months of Bank Statements

- This one is self-explanatary but hard to do as it can be a pain and overwhelming to look at 3 months worth of bank statements. Really the goal here is to print them out and highlight the things you spend the most on: groceries, going out to eat, subscriptions, color coordinate this part to get a better view of this.

- If color coordinating is too much, make sure to at least review each entry over 3 months (90 Days) to ensure you have a clear idea (which you will most likely see trends in spending right away) of where the majority of your money goes each month.

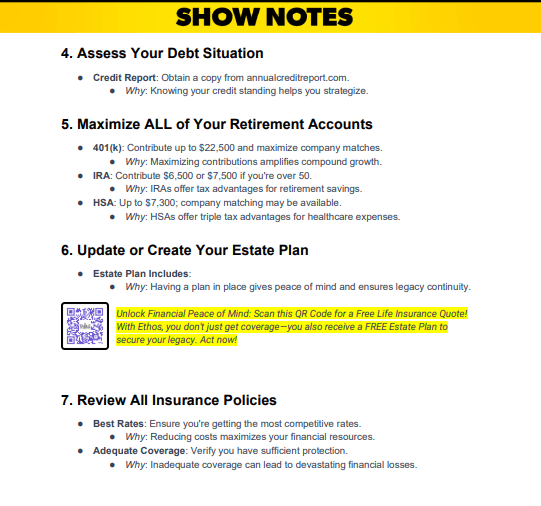

- Assess Your Debt Situation

- Here we can check on Experian or Annualcreditreport.com to take a closer look at what our credit report shows when it comes to our current debt situation.

- Knowing our current debt, can help us establish our plan of attack regarding the debt snowball (paying off debt smallest to largest except for mortgage which is Dave Ramsey’s second baby step out of 7). More on Dave Ramsey’s baby steps HERE

- And where I differ from Dave Ramsey and Anthony Oneal is I think having a good credit score is important if in the event you have an emergency come up where you need to take out a loan or have a ONE credit card for business expenses just in case. The issue is we as consumers can be compulsive and overspend and use credit cards as not just a bail out but as monthly income. This can get us in trouble when it comes to more debt and unwanted expenses.

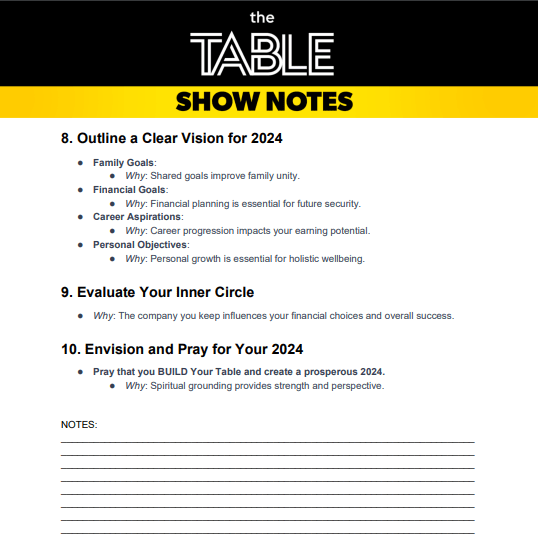

- Outline A Clear Vision For 2024

- What’s your vision for yourself and/or your family? This is what we’ll look to expound on or put into place in 2024 and beyond. A written out vision is just as powerful as verbal affirmations (if we believe what we say with authority) when it comes to how we condition our mindset.

- The more we see it, the more it’s in the forefront of our minds, and the more we can hold ourselves accountable.

- Pray and Envision what you want to Achieve in 2024

- Keep praying and believing in your God given abilities and purpose/vision (becoming the person you believe you are and not the outcome of the process you see) you have for yourself and family in 2024. We are not the results of our failed plans or bad decisions, rather, they are life lessons to learn from and gain perspective for our success.

- Keep praying and believing that you can achieve your goals even though there’s a lot of negativity in the world or you don’t see change right away. Consistency with intentional action (or action that yields the best results) is key here.

Remember our mindset and emotions are directly tied to how well we implement the plan for our finances and work towards other goals we set for our lives. Looking at an ANTI-VISION (a term I got from successful life and mindset coach Dan Koe) where you reverse engineer your goals and focus on what you don’t want to happen in 2024, can help us appreciate and value the things we want to accomplish even more. It can also help us put safeguards in place to avoid the things or old habits we don’t want to fall into per our Anti-Vision.

This approach can help us stay on the path of achieving our goals and keep our vision in perspective, while encouraging our subconscious to visualize the best version of ourselves, finances, and living in our definition of success, at the fullest/highest level. So HERE’S TO A PROPEROUS 2024 and BEYOND! WE GOT THIS

What Do These Four Words Mean To You? Give One Word Answers To Help with Vision Board Next Year:

Full Episode HERE